Property trading in Ho Chi Minh City in the first and second quarters of this year was down from a year earlier.

According to a report by the city Department of Construction, it was down 11.6% for the combined period. The number of real estate brokerages being established in the first half of the year halved to 689.

The city only had two housing projects approved in the first half of this year, while 62 others awaited approval.

Cumbersome and time-consuming approval procedures have led to housing shortages, especially in the social and affordable segments.

Many companies in the industry are struggling to survive.

The chairman of a housing development company based in Binh Thanh District said revenues have been zero in the past 12 months, debts have shot up, and growth has been negative since the second quarter of 2022. He had to pledge personal assets to get loans to repay the debts.

The company had to halve selling prices to spur sales. “After salaries were halved last year, more than 80% of our employees quit, but the company owes them salaries for three quarters. We do not know how we can pay them.”

A company based in District 3 is in a similar situation. Since 2022 it has gradually reduced prices to boost sales.

The Ho Chi Minh City Real Estate Association said demand is currently very weak, leading to lack of cash flows for housing companies.

Le Hoang Chau, its chairman, said easier access to bank loans would be a lifeline for real estate businesses.

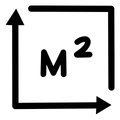

Vo Hong Thang, deputy director of R&D at real estate consultancy DKRA Vietnam, expected housing bought for occupation at prices of less than VND50 million ($2,111) per square meter and social housing for low-income people could see a recovery by 2024, but not properties bought as investment.

He said any revival depended on three factors: economic recovery, mitigation of legal issues plaguing real estate development and easy availability of bank loans and a decline in interest rates on them to below 9%.

Demand for land and housing could increase from September-October if deposit interest rates and then lending rates are lowered, he said.

All this could happen at the turn of the third quarter and the fourth quarter, usually the peak season for the sector, he added.